2023 Market Outlook

The Rig Market

More reactivations, M&As and $500,000 dayrates: Westwood’s top three 2023 rig market predictions

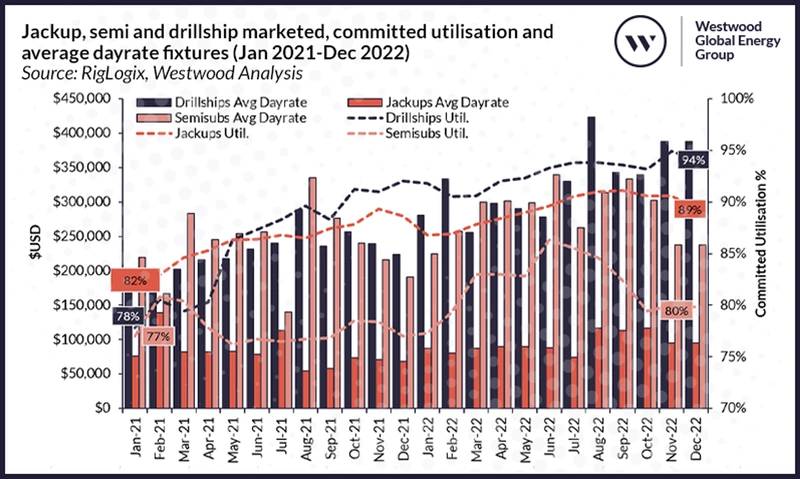

The offshore drilling rig market has blossomed this year off the back of the sustained E&P upcycle, with jack-ups, drillships, and semi-submersibles (semi) all recording increases in demand, marketed utilization, and dayrates.

By Teresa Wilkie, Director of RigLogix - Westwood Global Energy Group

The offshore drilling rig market has blossomed this year off the back of the sustained E&P upcycle, with jack-ups, drillships, and semi-submersibles (semi) all recording increases in demand, marketed utilization, and dayrates.

The drillship market is close to sold out at 94% marketed utilization, with leading-edge dayrates now hitting the mid-$400,000 range in both the US Gulf of Mexico and Brazil. The tightness within the market has already led to nine drillships being reactivated (2021-present) from cold stack and even a few stranded newbuilds finally landing their first drilling gigs.

Similarly, for jack-ups, urgency for capacity from National Oil Companies (NOCs), especially in the Middle East, has transformed the supply/demand balance within this market and, like the drillship fleet, has led to long-idled newbuilds finding work and 25 rig reactivations since 2021. As a result, rig owners have also realized substantial dayrate increases.

The semi fleet has had a slower recovery, largely due to lackluster demand from the North Sea. Nevertheless, rig owners have seen increases in utilization, and dayrates and marketed utilization now sits at 80%.

Extra capacity will be required

With the rig market recovery well underway, Westwood anticipates continued momentum in 2023.

The tightness in drillship and jackup capacity will be amplified next year as the demand outlook for these rigs is strong. Westwood's RigLogix records a total of approximately 40 years of unfulfilled floating rig (semi and drillship) requirements and around 93 years of jackup requirements that have a start date in 2023.

This high demand is expected to not only soak up the remaining active available supply in the market, but also additional newbuild units as well as cold-stacked tonnage that will require reactivation (see Figure 2).

However, commissioning a newbuild/stranded asset or reactivating an idle one is not a cheap or quick process. It is understood that pricing for a drillship reactivation is now $100 million or more and is likely to take 1-2 years to complete. This challenge may lead to some operators considering chartering a semi instead of a drillship where possible.

Dayrates will move higher still

This rising demand, coupled with a shrinking supply of ready supply and the soaring economics behind reactivation, brings us to our next prediction: dayrates will continue to rise next year.

As shown in Figure 1, dayrates have already been moving north, and rumors suggest that we could see a $500,000 drillship fixture next year, which would be the first since the 2012-2014 period. Meanwhile, jack-up rates are also expected to continue their upward trajectory, driven by continued high demand from NOCs, and Westwood anticipates seeing further fixtures for non-harsh environment units within the recently recorded $130,000-$140,000 range.

Westwood’s Offshore Rig Dayrate Forecast Report also shows that even the historically low rates for jack-ups in regions such as India will also rise in 2023.

Further upward movement for semi rates is even expected next year in both the harsh and non-harsh environment fleets.

The UK semi market is already showing signs of some tightening, and the Norwegian 6th generation segment is also expected to become busier in the second half of 2023. Several units have mobilized out of the region in 2022, and the lower supply will contribute to further tightening and dayrate increases.

More consolidation on the cards

One of the biggest talking points of 2022 was the merger of Noble Corporation and Maersk Drilling – a sizeable combination and a key example of what the industry has been promoting for many years.

With rig market fundamentals improving and drilling contractors streamlining their fleets in the past few years, it seems to be the prime time for further merger and acquisition (M&A) activity.

Rumors continue to circulate of ongoing talks regarding certain rig owners. However, time will tell if and when these discussions lead to further M&A activity. Despite rig market improvement, it is widely recognized that there is still too much rig owner fragmentation, and further consolidation will be required to provide a smaller pool of players with larger market shares in the future.

About the Author:

Teresa Wilkie is the Director of RigLogix within Westwood Global Energy Group, leading a team of experienced offshore rig market analysts. She has over a decade of knowledge as an analyst in the oil and gas industry brining expertise from her time at IHS-Markit (formerly ODS-Petrodata) and Esgian (formerly Bassoe Offshore).