Going Green

Floating Offshore Wind

Floating Wind Push: The Industrial Opportunity at the Edge of Europe

By Jon Salazar, Founder and CEO of Gazelle Wind Power

We are entering a new era—one where energy sovereignty, not just sustainability or cost, shapes investment and policy decisions. In this environment, nations are prioritizing local, resilient energy generation over imported or intermittent alternatives. Portugal, with its unique blend of geography, industrial capability, and political will, is positioning itself at the heart of this shift. This article outlines how floating offshore wind can help the country meet its decarbonization targets while strengthening energy security and advancing economic opportunity.

In recent months, Portugal has stepped up its efforts to harness offshore wind, particularly floating offshore wind technology. With its favorable natural conditions, active industrial base, and progressive energy policies, the country is fast becoming a leading destination for investments in wind energy—even amid ongoing political volatility.

Floating offshore wind, which allows turbines to operate in deeper waters where fixed-bottom foundations are not feasible, represents an ambitious leap forward. Unlike fixed-bottom turbines anchored to the seabed, floating turbines rely on buoyant structures tethered by advanced mooring systems and anchors. Portugal’s expansive Atlantic coastline offers some of the best conditions in the world for this technology.

These assets present an opportunity not just for decarbonization, but for rethinking how Europe secures its energy. Portugal's strategic ambitions align with global trends, with floating wind capacity projected to reach 300 GW worldwide by 2050, according to the Global Wind Energy Council (GWEC). The country has set a 2 GW target for 2030, aiming to expand to 10 GW by 2040.Government statistics underscore Portugal’s renewable progress. In 2023, wind became the largest source of renewable electricity, supplying 29% of the country’s energy. Renewables overall contributed 71% of total electricity generation, peaking at over 80% in December 2023. The government is targeting 51% renewables by 2030—an increasingly attainable goal.

This commitment goes beyond climate leadership. By boosting its renewable share, Portugal reduces reliance on fossil fuel imports, strengthens its position in the EU’s energy transition, and builds resilience against geopolitical and market volatility.

Geography, Technology, and Industrial Strength

Portugal’s Atlantic coast, with 1,794 kilometres of shoreline, offers deep waters and consistent offshore wind speeds of 7–10 m/s—ideal for floating turbines. Moderate wave conditions and low seismic activity add to its suitability.

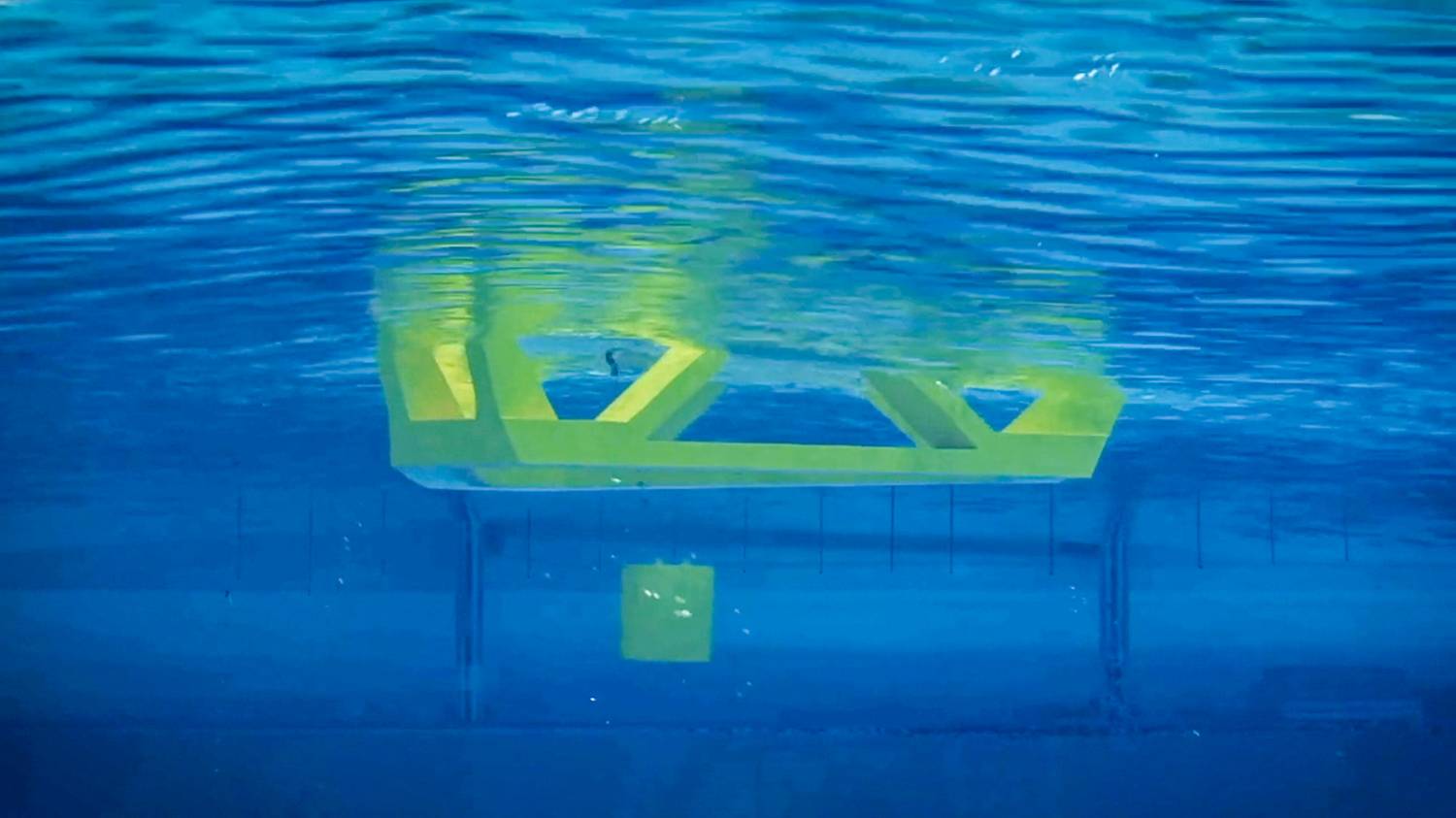

These natural conditions support both deployment and innovation. Gazelle Wind Power’s floating platform and dynamic mooring system technology are specifically designed for these conditions—ensuring stability, modularity, and performance in a high-energy maritime environment.

Portugal also offers industrial proximity to Europe’s major energy markets. Floating wind farms can directly connect into the continental grid, positioning Portugal as a natural energy exporter within the EU. This geographic advantage is equally compelling for global investors seeking to align their strategies with Europe’s long-term energy goals.

A Policy Framework in Flux, Yet Moving Forward

In November 2023, Portugal launched the first phase of a 3.5 GW offshore wind auction, focused largely on floating wind. This auction structure includes Contracts for Difference (CfDs) to provide stable revenues and attract investment. These financial tools reduce market risk and unlock capital for innovation.

Yet these developments take place amid recurring political turbulence. Portugal has now experienced three government collapses in as many years, creating uncertainty around policy continuity. However, the country has consistently shown a commitment to honouring existing frameworks and supporting strategic sectors like renewables—even during caretaker administrations.

Further reinforcing its innovation agenda are the Technological Free Zones (TFZs), which streamline permitting and provide fiscal incentives for testing new floating wind systems. TFZs give developers the ability to prototype and industrialize innovations faster, accelerating progress from lab to market.

Ports, Supply Chains, and Workforce

Portugal’s ports—such as Setúbal and Viana do Castelo—have the potential to serve as industrial hubs for the assembly and logistics of floating platforms. These sites benefit from Portugal’s legacy in shipbuilding and marine engineering, offering a skilled workforce, modular fabrication capabilities, and easy access to the Atlantic.

However, as seen across Europe, critical infrastructure gaps remain one of the major bottlenecks for floating wind deployment. While Portugal has the infrastructure to support smaller projects, to reach scale, projects will require significant port upgrades, including heavy-lift capacity, laydown space, and grid connectivity.

Furthermore, supply chain uncertainty is delaying investment in component manufacturing and facility upgrades. This contributes to long lead-times for turbines, substations, and other critical infrastructure. Without stronger demand signals and coordinated policy action, this supply chain inertia could threaten the timely delivery of national renewable targets.

Financing the Future

Despite growing momentum, floating wind is entering a more selective financial environment. A broader capital crunch in the offshore wind sector—driven by project impairments and investor pullouts—has raised the cost of capital. Investors are shifting toward lower-risk markets and proven technologies, making it more difficult for innovative floating wind projects to secure funding.

One key factor increasingly shaping the pace of deployment is the cost of financing. As interest rates remain high and macroeconomic uncertainty looms, insurance premiums – especially for novel technologies operating in harsh offshore environments – are becoming a major component of project risk profiles. This in turn raises the cost of capital, making innovation not only a technical but also a financial issue, and a key driver of capital.

Strategic Takeaways for Portugal and Beyond

To move from promise to performance, Portugal and its peers must act decisively:

-

Policy certainty must match ambition. Announced targets need follow-through with timely auctions and clear permitting pathways.

-

Infrastructure investment must precede project investment. Grid and port upgrades are part of the critical path and must be de-risked early.

-

Industrialisation is essential. Supply chains need visibility and volume guarantees to justify expansion.

-

Credibility attracts capital. Financing will flow to projects that combine technical readiness, political alignment, and predictable economics.

Portugal offers a unique opportunity to demonstrate that innovation—particularly in floating platform design, mooring systems, and system integration—can unlock the scale, cost reduction, and energy resilience needed for this next phase of offshore wind. For Gazelle Wind Power it’s about pioneering the solutions that can make floating wind affordable and viable at industrial scale.

Portugal’s success will depend not just on its natural resources, but on its ability to turn targets into timelines, and policy into projects. If the country continues to align infrastructure, supply chain, and financing tools behind its floating wind ambition, it will be well-positioned to emerge as a European leader in this vital sector.

About the Author

Jon Salazar

Jon Salazar is the CEO and founder of Gazelle Wind Power, overseeing the development and commercialization of the company’s hybrid floating offshore wind platform.