Markets

Exploration

Deepwater Displacement: Sixth Generation Semi-Sub Rig Values Under Pressure

Chevron’s Anchor project achieved first oil in August 2024 from two wells, marking the first development in the Inboard Lower Tertiary and initiating the deepwater 20,000 psi (20k) era. Despite reservoir uncertainty, early results are promising as AP001 delivered approximately 15,500 bbl/d and AP002 aound 18,500 bbl/d. Eleven wells are planned in total, with current performance indicating strong development potential, with arly well results demonstrating outperformance.

By Milan Patel, Analyst, North America Upstream Research at Welligence Energy Analytics

Discovered in 2014, Chevron’s Anchor field targets Lower Tertiary Wilcox reservoirs at vertical depths of 30,000–34,000 ft. Four appraisal wells were drilled, including Anchor #2, which encountered 690 ft of net pay across the Wilcox 1–4 sands. Anchor #3, drilled three miles northwest, confirmed a separate northern fault block, delineating the broader field structure.

Two production wells were drilled in early-2023 and brought online in August 2024. Both were completed across approximately 890 ft of net pay, utilizing five and six hydraulic fracturing stages respectively. Current production is sourced from the Wilcox 1–3 intervals, with Wilcox 4 targeted for future development. Core and log analyses indicate reservoir quality varies across the four sands, with permeability ranging from 1 to 100 mD and porosity between 18–24%.

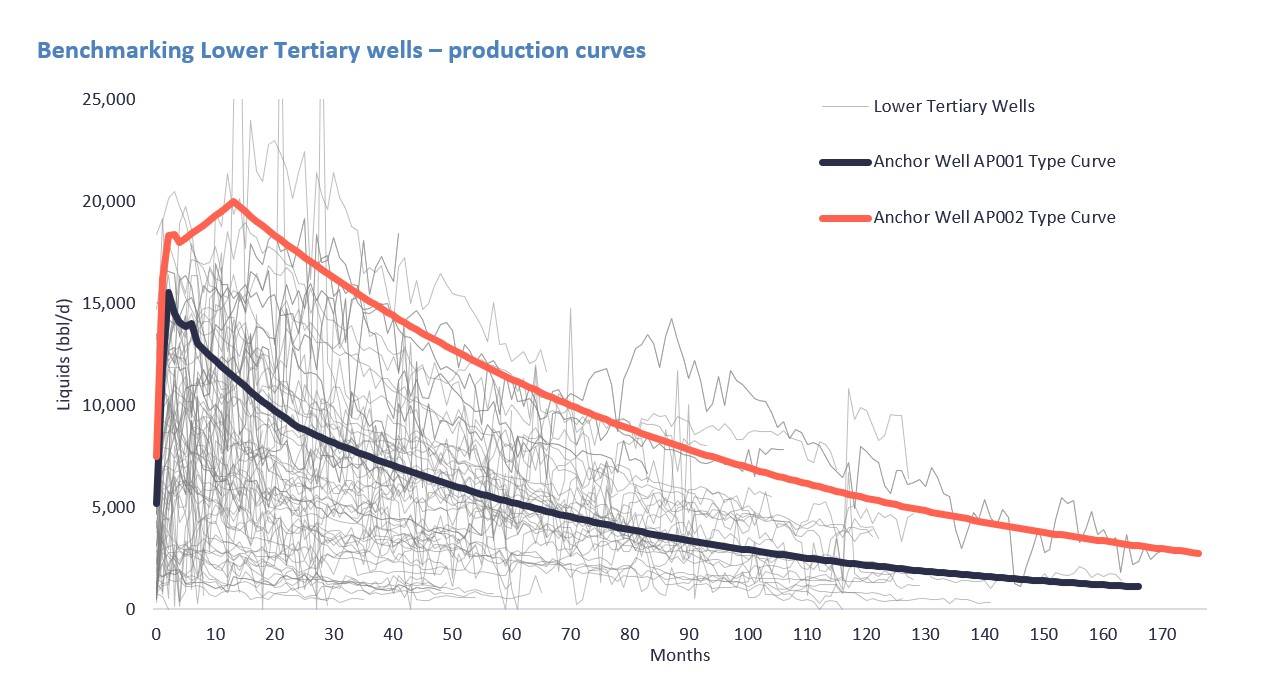

Anchor well performance is top tier in the Lower Tertiary

The initial Anchor wells compare favorably to recent Lower Tertiary developments. A benchmarking analysis against a reference set of Outboard Lower Tertiary and Perdido fields (brought online within the past 15 years) shows Anchor’s 3 and 6-month cumulative production volumes in the 80th–95th percentile range. Normalized over the first 90 days, Anchor wells exceed the Lower Tertiary average by 60–70%, placing them among the most productive in the Gulf of America/Mexico basin to date.

The Inboard Lower Tertiary is characterized by elevated pressures, with Anchor reaching 16,700 psi – this necessitates the use of 20k-rated equipment. The Inboard play features superior reservoir quality relative to the Outboard, characterized by coarser-grained sands, higher porosity and permeability, and larger structural traps. In the central Inboard, the thick overlying salt complicates seismic imaging and drilling but moderates thermal gradients, creating a cooler HPHT regime at extreme depths. For reference, Perdido well perforations average ~15,000 ft TVD, Outboard wells range from 25,000–28,000 ft TVD, while Anchor exceeds 30,000 ft TVD.

Could We See Reserve Upgrades at Anchor?

With two wells online and early production exceeding expectations, Anchor shifts into full-scale Phase 1 development. Five additional wells are planned over 2025-2027, bringing the total to seven producers tied back to a 75,000 bbl/d semi-submersible FPU, focused on the southern fault block. Phase 2 will target the northern fault block with up to four wells. Waterflooding remains a potential future option. Chevron estimates ultimate recovery at ~440 MMboe.

Recent BSEE regulatory updates have increased the allowable downhole commingling pressure differential in Wilcox reservoirs from 200 psi to 1,500 psi. Operators may now combine multiple zones with broader pressure variation, subject to fluid compatibility and safety standards. In the context of the Inboard Lower Tertiary, where Wilcox pay intervals may exceed 1,000 ft, this change is expected to significantly reduce drilling and completion costs while enhancing recovery efficiency through multi-zone completions. DOI estimates the new rule could boost production by up to 10%.

What’s Next – All Eyes on Shenandoah as 20K Trend Builds Momentum

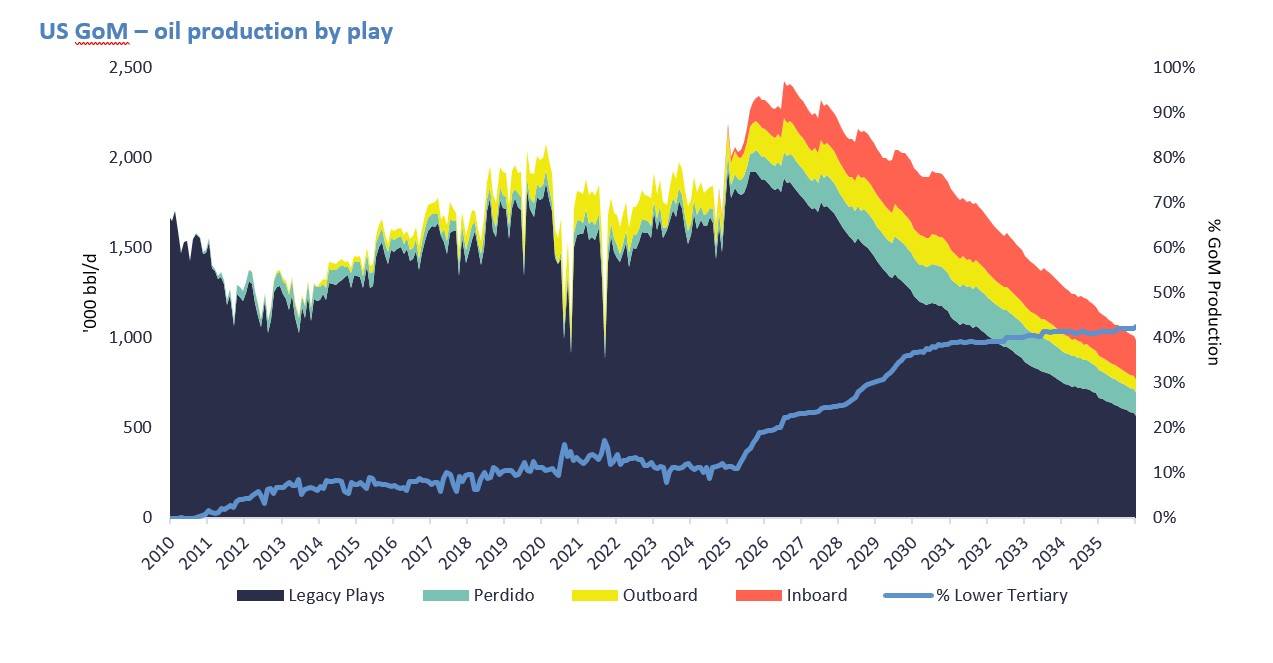

Chevron’s Anchor marks the beginning of a new wave of large-scale 20k developments in the Gulf of America/Mexico, with several high-pressure projects slated to come online by decade’s end. Currently, the Lower Tertiary contributes over 300,000 bbl/d to deepwater US GoM production, a figure that will grow significantly as more 20k projects come online. Within the next decade, we forecast the Lower Tertiary will account for nearly 50% of total deepwater production in the US GoM, including:

-

Shenandoah: The Beacon Offshore Energy project is scheduled for start-up in June 2025, with four wells online by year-end. The 120,000 bbl/d semi-sub FPU will be expanded to 140,000 bbl/d under Phase II. The facility will serve as a regional hub, with tiebacks from Monument (2026) and potentially Shenandoah South (unsanctioned).

-

Sparta: Formerly North Platte, the project was sanctioned by Shell in December 2023. Development will utilize a 100,000 bbl/d semi-sub FPU, similar to the Major’s Vito and Whale. First oil is targeted for 2028.

-

Kaskida: Sanctioned by bp in July 2024, Kaskida will be developed through an 80,000 bbl/d semi-sub FPU with first oil expected in early-2029. The company plans to follow with Tiber (FID expected 2026), also a standalone facility. Gila, Guadalupe, and Chevron’s Gibson may be tied in later. bp estimates the broader Kaskida-Tiber area could hold up to 10 Bnboe of recoverable resources.

About the Author

Milan Patel

Milan Patel is a North America Analyst at Welligence Energy Analytics, based in Houston. He covers upstream activity in Alaska and the U.S. Gulf of America/Mexico. He holds a Masters in Business Analytics and a Bachelors in Petroleum Engineering from the University of Houston. Prior to joining Welligence, he worked in acquisitions and divestitures across the Lower 48.

©Welligence Energy Analytics

©Welligence Energy Analytics