Markets

Exploration

Decarbonization Strategies in the Offshore Oil and Gas Industry: Navigating the Path Forward

In recent years, the oil and gas industry has faced mounting pressure to address its environmental impact. This has led many companies to set decarbonization targets – we are tracking more than 460 targets set by independents, majors, and NOCs across the sector. However, achieving these goals is a complex challenge and uncertainties persist about the most effective strategies to reach said targets.

Fernando Tamayo, Emissions Team Lead, Welligence Energy Analytics

Upstream Commitments Towards a Net Zero Future

Over 83% of companies we are tracking across the upstream sector have established greenhouse gas (GHG) emissions reduction targets. The number will rise as NOCs, which have historically lagged behind the rest of the industry in target-setting, finalize their decarbonization strategies. Moreover, as financiers come under increasing pressure to assess emissions linked to any project they fund, upstream companies lacking existing targets will be compelled to establish and publicly disclose their decarbonization strategy to secure financing.

Arguably, one of the most important sub-sets of the decarbonization targets being set are net-zero commitments. As of today, 70% of independents, 100% of majors, and 64% of NOCs have set net-zero targets. While most majors aim to reach Scope 3 carbon neutrality, in general, the industry will mainly target Scope 1 and Scope 2 emissions – only 14% of companies with net-zero commitments are targeting Scope 3 emissions.

Available Decarbonization Options

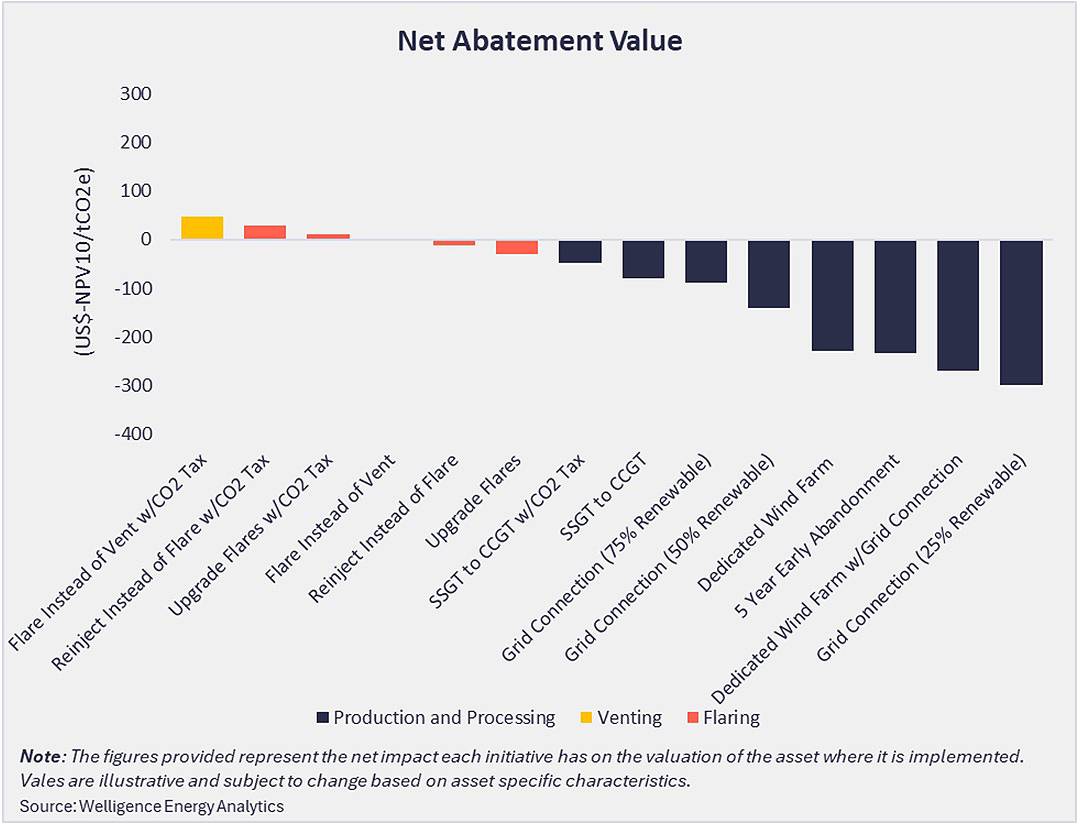

Nonetheless, the path toward net-zero is an uncertain one. This is primarily due to the cost associated with many of the decarbonization options available.

Initiatives targeting gas management, such as replacing venting with flaring, upgrading flares to reduce the amount of uncombusted methane that is released, or even drilling injector wells to limit the amount of gas that is flared or vented are relatively cheap. In some cases, these initiatives can even generate value for the asset in which they are implemented.

However, these initiatives will only take operators so far as around 60% of upstream emissions come from fuel consumption at production and processing facilities. These emissions are harder to abate and significantly more expensive, as fundamental changes to an asset’s infrastructure are required. Options include connections to the grid, building dedicated wind farms, or upgrading existing simple cycle gas turbines (SSGT) with more efficient, but costly, combined cycle turbines (CCGT).

Unfortunately, in many cases, such initiatives necessitate that the assets be taken offline for months, or even longer, as the production facilities undergo modifications. In other cases, such initiatives will force operators to incur heavy costs associated with new machinery, additional permitting, and environmental assessments. All to say that many of the initiatives being pitched will not be feasible for most offshore assets due to capital or time constraints – especially in assets that have already plateaued and have entered terminal decline.

The Economic and Environmental Case for ILX

Infrastructure-led exploration offers a viable solution as it offers a rare case where all parties involved can point to financial and environmental benefits. Furthermore, it’s a suitable strategy for mature offshore assets where facilities are underutilized.

Explorers can utilize existing infrastructure limiting the capital expenditure and time required to bring a project online, while at the same time avoiding the incremental emissions associated with new dedicated facilities.

Operators of the host infrastructure can share the cost and emissions linked to their production platform, extending the life of their asset while also decreasing the associated emissions of all tiebacks. This provides the market with incremental, low-emission barrels.

No better example of this exists than the Winterfell tieback to the third-party-operated Heidelberg Spar in the US Gulf of Mexico. By 2023, the Heidelberg Spar had become one of the highest emitting fields/facilities (on a per barrel basis) in the US Gulf of Mexico. However, after Beacon Offshore Energy made the Winterfell discovery, Occidental, the operator of the Heidelberg Spar, decided to open up its facility to host production.

For the Heidelberg field/spar, the tieback meant that a significant share of the operating costs was passed onto the Winterfell consortium in the form of processing and handling (P&H) fees. This eased the OPEX burden on the Heidelberg field, leading to an extended economic limit, and ultimately an increase in valuation of nearly $400 million. Furthermore, the tieback also transformed the facility from one of the highest-emitting (on a per barrel basis), with an intensity of 35 kgCO2e/boe before Winterfell came online, to one of the lowest emitting facilities in the world with an intensity of ❮4kgCO2e/boe once Winterfell is fully online.

About the Author

Fernando Tamayo currently leads the Emissions team at Welligence Energy Analytics, based in Houston. He has extensive knowledge in the upstream oil and gas sector, with a focus on emissions and decarbonization. He was responsible for the design and implementation of the Welligence Greenhouse Gas (GHG) offering.