Managing Offshore Oil & Gas Through Energy Transition

Scientists warn that climate change is the greatest peril that humankind has ever faced. Yet oil and gas exploration is set to clock the highest growth for more than a decade this year and next. Protesters cause disruption but, for the moment, hydrocarbon energy underpins life as we know it.

By Paul Bartlett, London

“Offshore oil and gas production probably matters now more than ever,” declared Audun Martinsen. The Rystad Energy Partner and Head of Energy Research told Offshore Engineer.

“It is one of the lower carbon-intensive methods of extracting hydrocarbons and there is significant scope to decarbonize the production process further. Offshore operators should expect a windfall in the coming years as global superpowers try to reduce their carbon footprint while advancing the energy transition.”

Martinsen was commenting after the Oslo-based firm revealed that offshore oil and gas investment is lined up to hit $214 billion in the two years ending December 2023, the first time it has reached this 24-month level since 2012-13. And offshore activity is expected to account for 68% of all sanctioned conventional hydrocarbons this year and next, up from a pre-pandemic average of around 40%.

There are many factors at work, but post-Covid recovery, China’s re-opening, and Russia’s invasion of Ukraine have driven energy security to the very top of the agenda in many countries. The war in Europe is causing a cost of living crisis in many countries, and widespread food shortages in others.

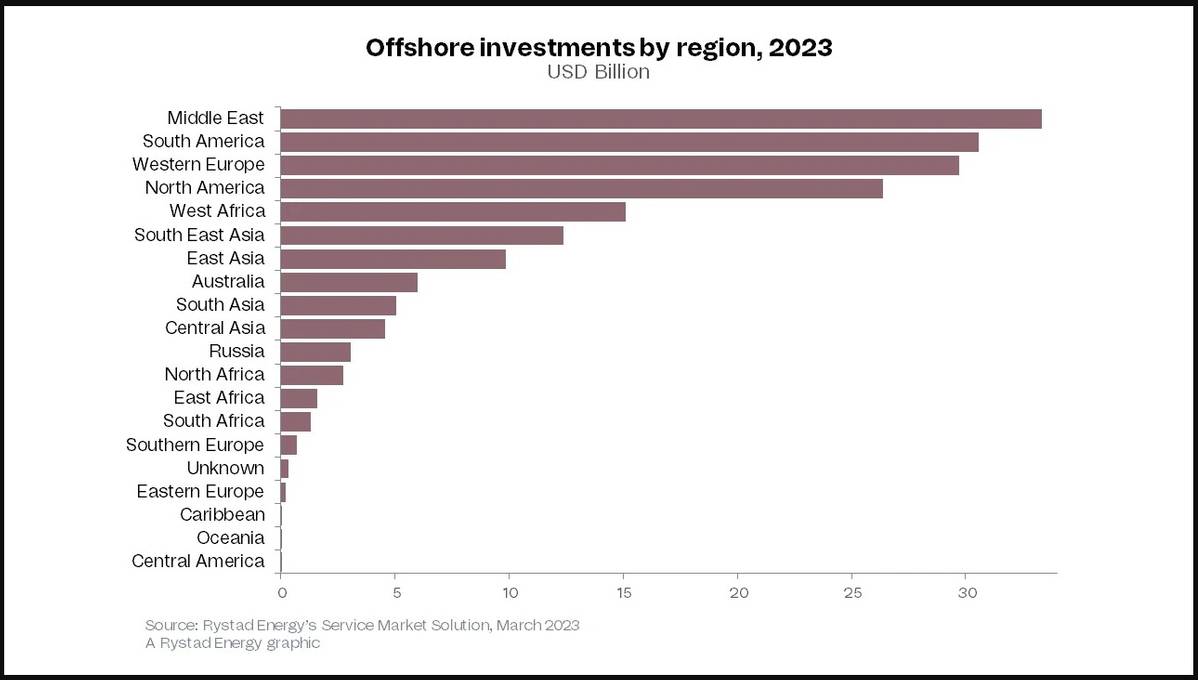

Rystad’s analysis reveals that the Middle East is a hotspot for spending (see chart). Offshore capex across the region will exceed all others, driven by huge projects in Saudi Arabia, Qatar, and the United Arab Emirates, according to Rystad analysis. But strong growth is evident elsewhere , too.

South America, notably Brazil, is second, followed closely by Western Europe, specifically the North Sea. North America comes next, with more than $17 billion of capital investment expected this year.

What’s the problem?

There is clearly a public perception problem, not helped by the super-profits clawed in by the world’s largest energy majors over the last two years. Electric cars may help by replacing gas guzzlers to some extent, but global lithium supplies could not sustain a long-term switch without new technologies.

Bluntly, there is no short-term option to hydrocarbons as a means of fueling the planet. So the challenge becomes hastening the transition; imposing as little further damage as possible in the process; and mastering a collaborative response, experts say.

Unfortunately, as they point out, many of today’s demonstrators and protestors do not realize that hydrocarbons are fundamental to most aspects of everyday life – not just fuel for making steel, running most cars and buses, and heating or cooling homes. The petrochemicals sector provides key components for many everyday products – including plastics, fertilizers, rubbers, clothes, medical equipment, detergents, adhesives, pesticides, and paints and coatings.

Asked recently what she would say to a ‘Just Stop Oil’ protester stuck to a gantry, Lloyd’s Register’s Claudine Sharp-Patel thought about this long and hard. “I think I’d like to ask them where they got the glue,” she said.

So, on the basis that we have no scalable options to hydrocarbons in the short run, what can we do?

New Strategies

Wood Mackenzie has developed a new analytical tool, Lens, to help exploration personnel identify the most attractive opportunities in oil and gas that are likely to generate the best returns. The firm’s Vice President of Exploration, Andrew Latham, described how access to data has facilitated for more effective decision-making.

The tool is designed to demonstrate how different exploration opportunities compare, Latham said, and how their economics stack up. The quest now, he says, is to identify ‘advantaged’ oil and gas. This means lower cost, lower carbon, better access to markets, better fiscal terms, and lower risks. Also, how much of this resource might be available given a certain price point, a given set of circumstances, and/or a specific timeframe?

Norway, with the largest sovereign wealth fund in the world, huge hydrocarbon reserves, and an abundant supply of renewable hydroelectricity, stands in pole position to spearhead the drive for clean energy. State energy company, Equinor, aims to reduce net group-wide operated emissions by 50% by 2030 “and is focused on medium-term actions consistent with the goals of the Paris Agreement and a 1.5 degrees pathway”, according to a statement.

However, commenting recently on the future, Equinor said: “Even in the most optimistic forecast scenarios for the green shift, the world will still be dependent on oil and gas for a long time to come. It is therefore essential that oil and gas that the world needs is produced with as low a carbon footprint as possible.”

The company has adopted three ‘pillars’: carbon-efficient oil and gas production; expansion in renewables; and the development of new low-carbon technologies and value chains. As a leading developer of offshore wind, it is a pioneer in the rapidly developing floating wind sector, which offers scope to harness renewable energy in waters where the winds blow stronger and longer.

The company is nearing completion of the world’s largest floating wind farm, Hywind Tampen, almost 90 miles off the coast in the Norwegian Sea. The 11-turbine facility, with a capacity of 94.6 MW, will provide renewable electricity for the Snorre and Gullfaks oil and gas fields nearby. Its first electricity was generated late last year and when the wind farm is fully commissioned in a few months’ time, it will mean Equinor produces almost half of the world’s floating wind energy.

The N-word

Against this daunting backdrop, however, some experts claim that there are chinks of light. One of these is tried and tested technology which has received barely a mention until recently. Even in Norway where renewables are a top priority, nuclear power based on molten salt reactor (MSR) technology is now the subject of detailed research.

Concepts are being developed to provide carbon-free energy for hard-to-abate industrial applications. And, in a project developed by family-owned shipbuilding group, Ulstein, experts are working on generating power for a small fleet of expedition cruise ships. They could be deployed in high-north waters where conventional refueling would be impossible.

Meanwhile, in the UK, Core Power is pioneering the development of MSR technology for heavy industrial applications as well as the maritime sector. With offices in London and Washington DC, the company is working with international power, engineering and nuclear technology firms to generate zero-emission energy for floating industrial facilities, such as semi-mobile desalination plants, and power for deep-sea shipping.

Many advocates of nuclear power cannot understand the reticence to look at options. MSR technology is widely seen as safer than other forms of nuclear technology, they point out, because pressures are low and fuel is already in a molten state. In an emergency, it can be drained into a containment vessel before solidifying.

No surprise that Core Power’s Head of Analytics, Dr Rory Megginson, is a staunch advocate of the carbon-free energy source and a proven technology, he stresses, that is available today. “The belief that nuclear power is somehow unsafe and dangerous is a myth not born out by facts of science,” he said.

Megginson explained that green ammonia is likely to offer hard-to-abate industries, including shipping, an effective zero-carbon fuel at some time in the future. But as things stand, its production relies on the nascent science of carbon capture or the limited scalability of production from intermittent renewable sources.

On the other hand, MSR technology offers a large-scale source of clean energy suitable both for heavy industry and transport and, with one major advantage. Once installed, MSR technology would enable ships, steel mills, petrochemical plants and other heavy industries to use a constant source of energy supplied over a long period, perhaps 10-20 years.

And in shipping, the eye-watering cost of a global network of new bunkering facilities might not be necessary.