Markets

Offshore Wind: Baltic Sea Area

Baltic Sea Preps for Surge in Offshore Wind Project Activity

Tomasz Laskowicz, Research Analyst at Intelatus Global Partners

The Baltic Sea area offers the countries of the region (Poland, Estonia, Lithuania, Latvia, Finland, Sweden, Denmark and Germany) a large generation potential for offshore wind energy. The European Commission identifies the potential of the Baltic Sea for the installation of 93.5 GW of offshore wind farms, but this figure may be an underestimate. Developers plan to develop large-scale projects based on both bottom-fixed foundations and floating technologies, and countries are identifying new areas for offshore wind development. However, permitting processes take years, and the lengthy procedures coupled with inflation concerns create barriers to project development.

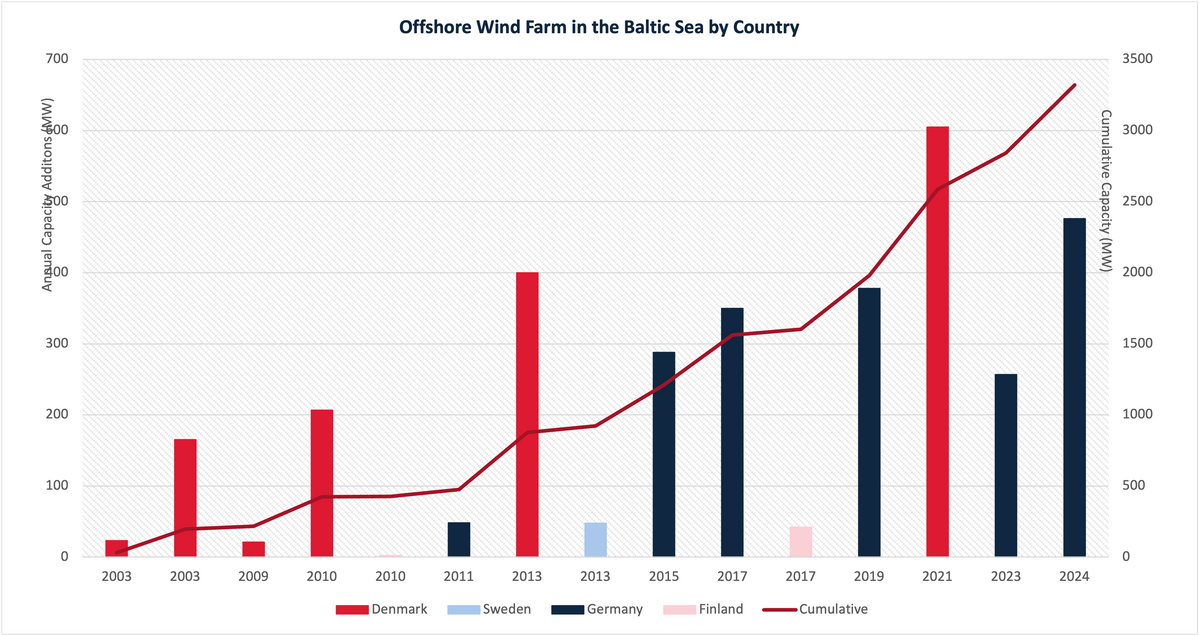

According to the Marienborg Declaration, 8 EU countries will develop 20 GW of offshore wind power in the Baltic Sea by 2030. There are currently only 15 wind farms operating in the Baltic, with a total capacity of 2.5 GW, and additionally two German projects with a total capacity of 700 MW are under construction. By 2024, around 720 wind turbines with a total capacity of 3.4 GW are likely to be operating in the Baltic.

The desire to realise ambitious target to achieve 20 GW of installed capacity in the Baltic by 2030 therefore means that the second half of the decade will be a busy one. There are currently more than 20 projects at various stages of development that could provide an additional 17 GW of installed capacity in the Baltic by 2030. These projects will mostly be based on large turbines of around 15 MW, meaning that between 2025 and 2030, around 1,100 to 1,300 turbines are forecast to be installed in the Baltic. However, almost all projects are currently in the process of environmental studies and permitting, which will allow the developers to make a final investment decision.

Of the seven Polish projects, with a total capacity of 5.9 GW, that have received support under the government's pricing support, none has yet obtained the necessary full construction permits. The projects are expected to be built before 2030, and some of them may possibly be grid connected as early as 2026. One of the most advanced projects in Poland is Baltic Power, developed by PKN Orlen and Northland Power, with a capacity of 1.2 GW. The project is the only one to have obtained a permit for the onshore part of the infrastructure, but the construction of the offshore part requires a separate permit. The time between bidding for the project and the start of the construction process reaches several years and exposes developers to the risk of negative changes in terms of price fluctuations, exchange rate risk (Poland is not part of the euro area), interest rate increases, which have a potential impact on investment returns. The projects under construction in Poland, with a total capacity of 5.9 GW, have most of the necessary environmental permits and could enter the construction phase in about two years. Polish developers have secured government guarantees for inflation indexation of the guaranteed off-take price, which was set at around €70/MWh in 2021. In Poland, preparations are also underway for the construction of port and supply chain infrastructure, with a decision taken to build a Vestas turbine factory and installation port in Świnoujście (western Baltic) and a tower factory in Gdańsk. The development of Polish projects with a capacity of around 16.5 GW, which may enter the realization phase, subject to the settlement of location proceedings, means the installation of around 1,000 turbines over the next 12 years.

Countries in the Baltic region are also taking up the challenge to launch their first offshore wind projects before 2030. Lithuania has announced one 700 MW auction and is reviewing an auction for a further 700 MW. The Elwind project, which is being developed by Latvia and Estonia, has received final site selection. In addition, Latvia intends to carry out a bidding process for a project of around 1 GW. The most advanced project underway in the Baltics is Saare Livii, which, in the first phase, is expected to reach 1.2 GW of installed capacity.

In Finland, offshore wind energy is expected to contribute to the 2035 climate neutrality target. Currently, the 42 MW Tahkoluoto is the only operational offshore wind farm in Finland, for which a 600 MW extension is planned. State-owned Metsähallitus is also developing a 1.3 GW wind farm in partnership with Vestas. OX2 is active in Finland and is building a portfolio of offshore projects also in Sweden, the developer announced in January that it had started studies on a 1.4 GW power plant project. The SeaSapphire joint venture is in the early stages of planning four floating wind projects off the coasts of Sweden and Finland, which could have an installed capacity in excess of 5 GW.

While Sweden aims to achieve climate neutrality by 2045, its efforts to date have not focused on offshore wind farms. While developers are proposing the development of numerous large-scale projects, including the 5.5 GW Aurora, many projects are in the early stages of development with no possibility of inauguration before 2032. At the beginning of February, OX2's 1.7 GW Galatea-Galene wind farm announced further project development approvals, which could result in construction starting as early as 2026.

Denmark is continuing to investigate the feasibility of the Hesselø offshore wind farm, for which a tender of up to 1.2 GW is planned for 2024. Denmark is also announcing the construction of an offshore energy island on the island of Bornholm in the Baltic Sea to accommodate wind farms of up to 3 GW. The project is to be carried out in cooperation with Germany.

Germany aims to achieve 30 GW of installed capacity by 2030 and 40 GW by 2035, some of which will be realised in the Baltic Sea. In January this year, Germany announced auctions of areas with a total potential of 7 GW of installed capacity, including 1 GW in the Baltic Sea. Further auctions will be announced in March.

Following the outbreak of war in Ukraine, countries in the Baltic Sea region have increased their interest in offshore wind energy in the Baltic. A number of projects with high generation potential are reviewing an accelerated permitting process, thanks to the determination of governments. The countries of the region do not intend to stop at the ambition of installing 20 GW in the Baltic by 2030. Further auctions are already underway to enable further offshore wind development.

In Poland, awarding of locations has begun for so-called second-phase projects, whose total installed capacity could exceed 8 GW. Two of the 11 identified sites have been awarded to state-owned energy giant PGE, which is already developing three projects in the Polish Baltic Sea, including two in cooperation with Ørsted. Further awards for the Polish second phase of support are expected soon, with the government considering extending support in the second phase to as much as 12 GW (against 5 GW in the auctions already planned). The 12 GW would be subject to auctions held between 2025 and 2031. This would mean that the Polish government is prepared to raise the total target for installing offshore wind farms by 2040 from 11 GW to 17.9 GW.

The need to build a source of energy, independent of energy imports, is pushing the countries of the Baltic region towards ambitious targets for the construction of offshore wind. Crucial to the ability to meet the installation targets in a timely manner at this stage appears to be the procedure for environmental assessment and the issuing of construction permits. The second half of this decade will be a busy time in the Baltic Sea as projects that are in the planning phase today succeed in entering the implementation phase.

We address all of these issues in our report on offshore wind in Poland and the Baltic States. Get access to the database and the complete report on offshore wind energy development in Poland and the Baltic States via Intelatus.com

About the Author:

Tomasz Laskowicz is Research Analyst at Intelatus Global Partners. He is a PhD candidate at the doctoral School of Social Economic Sciences at the University of Gdansk. Contact the author: tomaszlaskowicz@intelatus.com, +1 212 477 6700 xt2070